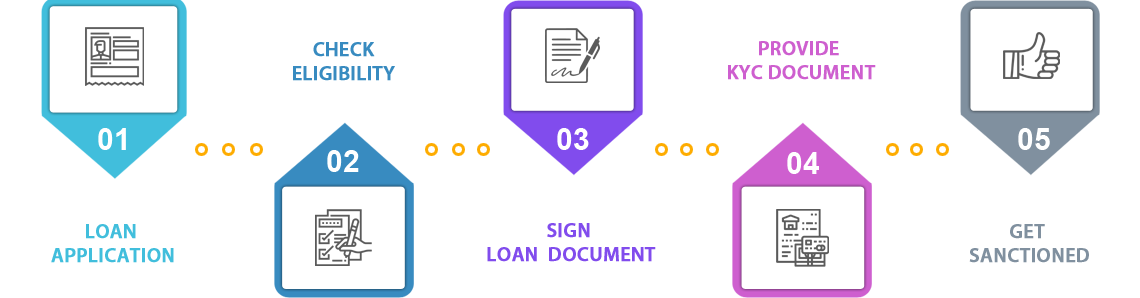

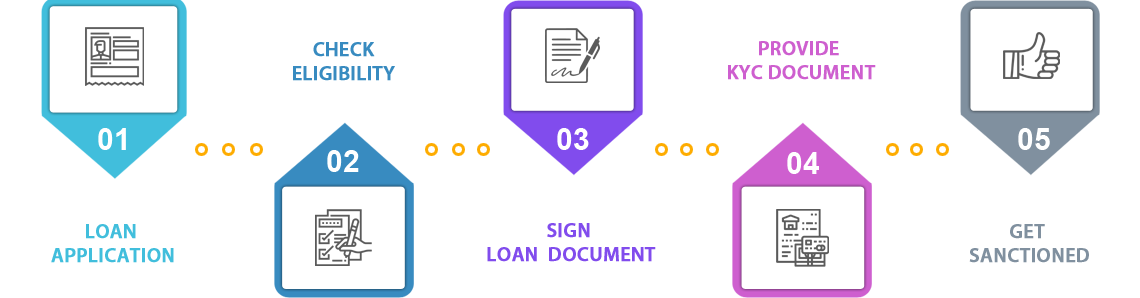

What do I need to do for a Personal Loan

Home Loan - Features and BenefitsGet a home loan up to Rs. 3.5 crore from NBFC Partners at the lowest interest rate in India with added features like additional top-up loan and doorstep service.Whether you’re looking to purchase your first home, or you want to construct your own house, or if you just want to renovate your current home, Bajaj Finance home loan offerings meet all your requirements. You can also reduce your home loan EMIs by transferring your existing home loan to us at the lowest rate of interest in India, plus a top-up loan up to 50% of your sanctioned home loan amount.To apply online for a CPay Home Loan today, and get instant approval on your Home Loan.Home Loan Eligibility CriteriaAge Limit of Salaried Individuals23 to 62Age Limit of Self-Employed Individuals25 to 70Required CIBIL Score for Home LoanMinimum 750Work experience of Salaried ApplicantsMinimum 3 YearsBusiness ContinuityMinimum 5 YearsMinimum SalaryRs. 25,000NationalityIndian, Residing within the Country

Want to fund your vacation but falling short on funds? An EMI based loan can be an ideal way to pay for a holiday that you can’t quite cover in one go. Whether it is backpacking through the mountains or you want to globetrot to your favourite destination, Pay u Loan for Travel is how you can make it happen. Head off on your next adventure. Our Travel Loan is simple, easy and fast!The Travel Loan is ideal for people who are seeking to finance their ideal vacation but are falling short on funds. It covers all the expenses related to your travel, such as, airfares or any kind of transportation, hotel fares, tour packages, travel gear/accessories, or any type of expenses that are associated with your travel. Apply for the Travel Loan quickly and be travel ready!

A marriage today comes with its fair share of frills, thrills and not to mention - Bills. An equal lifetime as partners, with highs and lows, joys and woes for better or worse, must begin with taking equal financial responsibility for your wedding too. A Personal Loan for Wedding enables you to pay for anything related to your special day. We help you find a loan that fits your budget in a timely manner and make your fairy-tale wedding come to life.Weddings are a time for celebration. They are special events that bring loved ones together and create new families. But at times weddings can be quite expensive for both the bride and the groom. Opting for a personal loan to meet your wedding expenses is an optimal solution to make the occasion memorable. without stressing over every rupee.

Renting new apartment means hassle. Right from searching to shifting in new accommodation. Expenses can be overwhelming. For salaried individuals, who move locations, changes homes, customized personal loans like Rental Deposit Loan helps solve financial worry for the security deposit of rented properties. When you take a loan of this nature, you do not disrupt your savings but adjust new expenditure in your monthly cash outflow. Hence, the bulk amount is saved for other purpose. Apart from this, when you shift there are many other expenditures that goes in settling into new environment as well. Also, by taking Rental Deposit Loan, you can take bigger apartment, or in better locality – in other words, select a house of your dream and not limiting yourself on finance.

© 2019 Pay you loan. All rights reserved | Design by Idaksh Technologies